Condo Insurance in and around Broken Arrow

Looking for outstanding condo unitowners insurance in Broken Arrow?

Quality coverage for your condo and belongings inside

- Tulsa

- Bixby

- Owasso

- Coweta

- Edmond

- Jones

- Oklahoma City

- Miami

- Muskogee

- Sand Springs

- Collinsville

- Bartlesville

- Wagoner

Your Search For Condo Insurance Ends With State Farm

When it's time to kick back, the home that comes to mind for you and your favorite peopleis your condo.

Looking for outstanding condo unitowners insurance in Broken Arrow?

Quality coverage for your condo and belongings inside

Safeguard Your Greatest Asset

Your condo is a special place. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted name for condo unitowners insurance. Jim Virtue is your caring State Farm Agent who can present coverage options to see which one fits your individual needs. Jim Virtue can walk you through the whole coverage process, step by step. You can have a straightforward experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your home gadgets, furnishings and furniture. You'll want to protect your family keepsakes—like collectibles and souvenirs. And don't forget about all you've collected for your hobbies and interests—like videogame systems and sports equipment. Agent Jim Virtue can also let you know about State Farm’s great savings and coverage options. There are savings if you have a claim-free history or have an automatic sprinkler system, and there are plenty of different coverage options, such as personal articles policy and even additional business property.

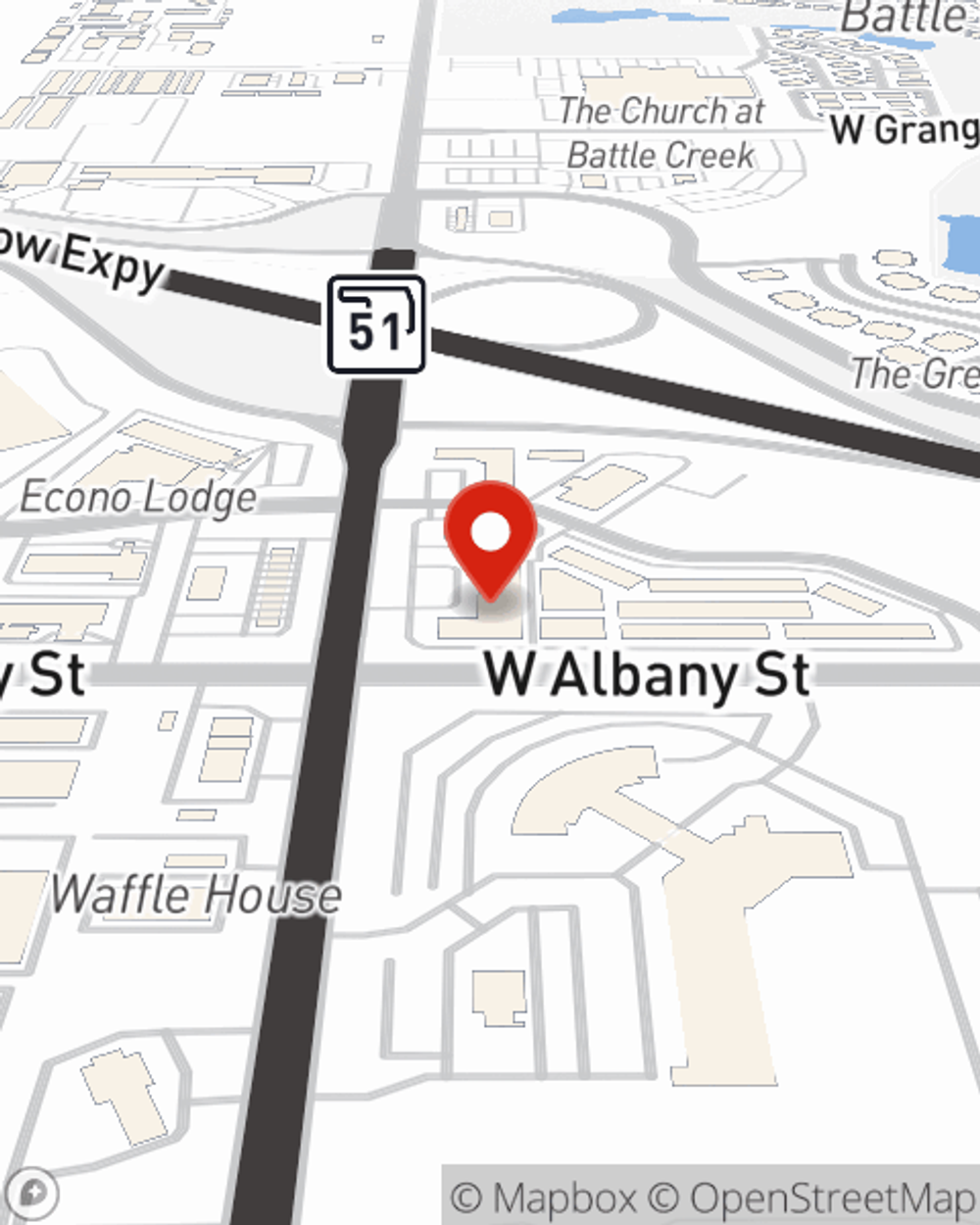

Ready to get going? Agent Jim Virtue is also ready to help you see what customizable condo insurance options work well for you. Visit today!

Have More Questions About Condo Unitowners Insurance?

Call Jim at (918) 251-1581 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.